Apply for instant E-Pan card for free

What is E-Pan?

The Income Tax Department has introduced a new initiative called e PAN card (electronic PAN). It is a digital version of the traditional PAN card, which can be used for financial and tax-related transactions. e-PAN facility is for allotment of Instant PAN (on near-real time basis) for those applicants who possess a valid Aadhaar number. PAN is issued in PDF format to applicants, which is free of cost.

Table of Contents

Also Read:https://coveragezone31.com/pan-card-2-0-essential-features-advantages

What is a PAN Card?

A Permanent Account Number (PAN) card is a unique, 10-character alphanumeric identifier issued by the Income Tax Department of India. It is primarily used for tracking financial transactions and ensuring that individuals and entities comply with tax regulations.

Key Features of PAN Card:

- Format: A PAN consists of 10 characters, typically structured as:

- First five characters: Alphabetical (the first three are a sequence, and the fourth indicates the type of holder, e.g., individual, company).

- Next four characters: Numerical.

- Last character: Alphabetical checksum.

- Holder Type (Who can Hold):

- Individuals

- Companies

- Trusts

- Hindu Undivided Families (HUF)

- Firms

- Validity: A PAN card is valid for a lifetime, irrespective of changes in address or financial status.

Why is PAN Card Important?

- Tax Compliance: Required for filing income tax returns.

- Financial Transactions: Mandatory for transactions like opening a bank account, purchasing real estate, or investing in mutual funds.

- Identity Proof: Accepted as a valid proof of identity across India.

Uses of PAN Card:

- Filing Income Tax: Used to track taxable income and tax payments.

- High-Value Transactions: Required for transactions above specific limits, such as deposits exceeding ₹50,000.

- Investments: Necessary for buying mutual funds, stocks, or bonds.

- Property Transactions: Used for property purchases or sales to prevent tax evasion.

- Banking: Essential for opening bank accounts and applying for loans or credit cards.

How to Apply for a for instant E-pan:

- Online: log in https://eportal.incometax.gov.in.

- On landing of homepage of income tax department, find quick links on top of left side and find Instant E-Pan

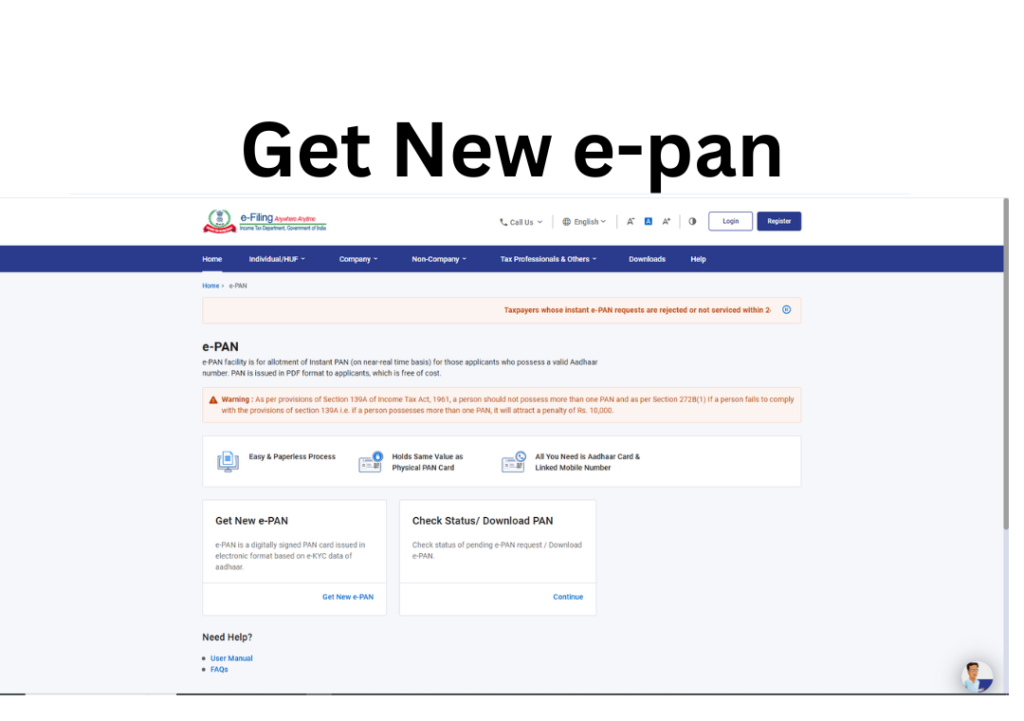

click on instant E-Pan and find Get New e-PAN on next page and click on same,

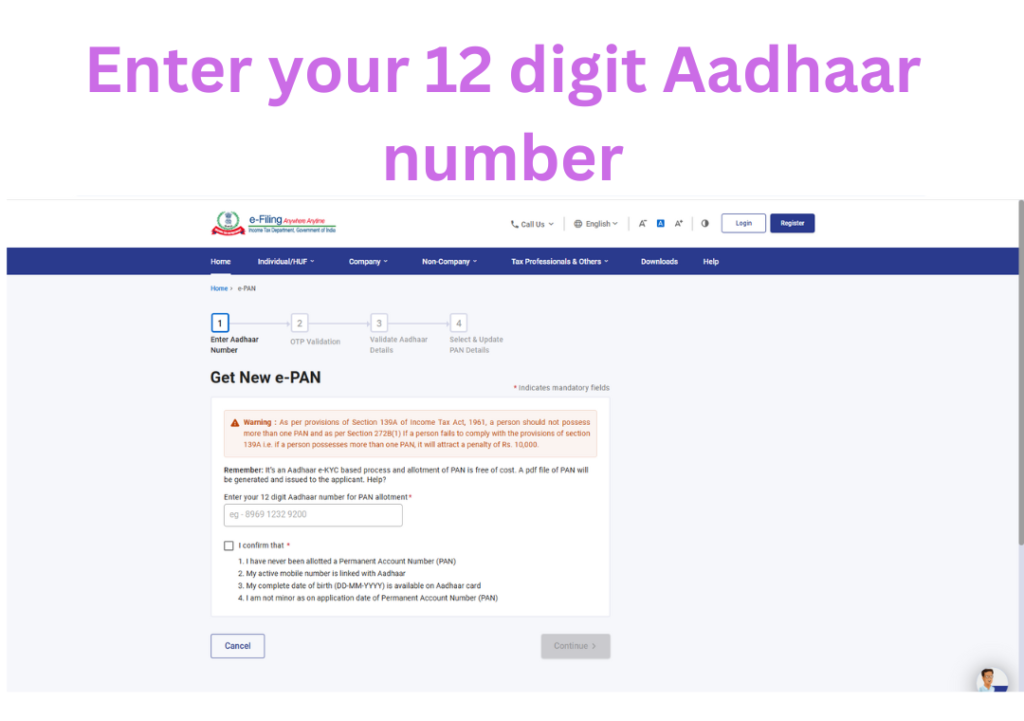

After landing on the next page and Enter your 12 digit Aadhaar number and click on confirm that check box

After Clicking on confirm that check box, click on continue and you will receive OTP on Aadhar registered mobile number

Enter the otp and validate Aadhar details and click on continue, select and update Pan Details and submit. After successfully submit of pan details you will Acknowledgement no. on Aadhar registered mobile number

Your Instant E-pan will be available to download, but sometimes it may take upto 24 hrs to update the details in NSDL server.

For checking of status / download pan, again you need to enter your 12 digit Aadhar number and click on continue download your E-Pan for free , which will be without individual sign. For Physical Pan Card visit online portal like NSDL PAN (now Protean) or UTIITSL. Upload your photos and signature on said portals and apply.

Conclusion:

A PAN card is a critical document for anyone engaging in financial activities in India. It ensures transparency in financial transactions and helps individuals and organizations comply with tax laws efficiently.

FAQ

- What is the difference between e-PAN and PAN?

Ans:- The Main difference: An e-PAN card is a digital version of the traditional PAN card, whereas a PAN card is a physically printed PAN card. While applying for a PAN card, a person can obtain an e-PAN card via email, a physical PAN card at a residential address, or both

2. Can I use ePAN instead of PAN?

Ans:- The instant e-PAN is a digital PAN card that is equally valid as a physical PAN. However, there are a few prerequisites that you must consider if you wish to avail an instant e-PAN: You have never been allotted a PAN card. You should not be a minor on the date when requesting your instant e-PAN.

3. Is an e-PAN card sufficient?

Ans:- Yes, e-PAN is a valid proof of PAN. e-PAN contains a QR code having demographic details of PAN applicant such as name, date of birth and photograph.