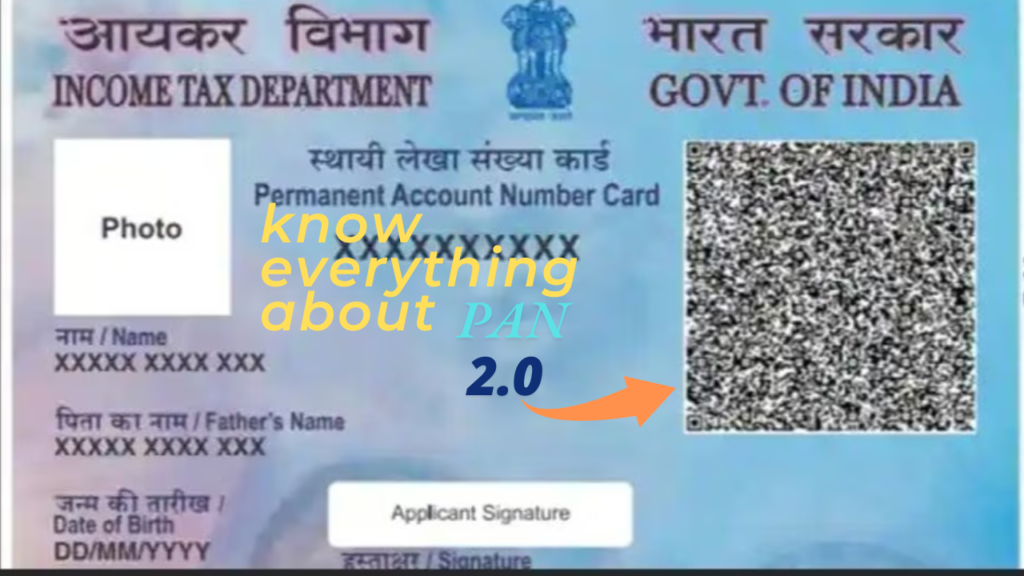

PAN Card 2.0: Essential Features, Advantages, and Procedure

PAN Card 2.0: In order to meet the demands of a digitally changing economy, the Indian government created PAN 2.0, an upgraded and digitally first version of the Permanent Account Number (PAN) card. PAN 2.0 transforms the nation’s financial identity management process with a focus on echnology integration, improved security, and a simplified user interface.

Table of Contents

Read Also:https://coveragezone31.com/oneplus-13

Here’s an overview of PAN Card 2.0, including its key features, benefits, and process:

What is PAN Card 2.0?

PAN Card 2.0 is an upgraded version of the traditional Permanent Account Number (PAN) card introduced by the Government of India to integrate advanced technologies and enhance usability. It aims to streamline processes, improve security, and offer digital-first benefits to citizens.

Key Features of PAN Card 2.0

- Dynamic QR Code:

- Contains personal and PAN details for instant verification.

- Helps reduce fraud and ensures easy sharing of PAN information.

- Paperless Format:

- Available in a digital e-PAN format for easy access and portability.

- Can be downloaded instantly after issuance.

- Enhanced Security:

- Features like encrypted QR codes, holograms, and other security measures prevent forgery.

- Integration with DigiLocker:

- PAN Card 2.0 can be stored digitally in platforms like DigiLocker for secure access.

- Instant Issuance:

- Applicants can now generate a PAN within minutes using their Aadhaar details.

- Eco-Friendly:

- Focus on reducing plastic usage with e-PAN cards.

Benefits of PAN Card 2.0

- Faster Processing:

- Instant issuance reduces the time taken to get a PAN card.

- User-Friendly:

- Digital format ensures accessibility anytime, anywhere.

- Fraud Prevention:

- Dynamic QR code and advanced security features safeguard against misuse.

- Ease of Verification:

- QR codes allow quick scanning for verification, beneficial for financial institutions.

- Cost-Effective:

- Reduces costs associated with printing and delivery.

- Enhanced Integration:

- Seamlessly integrates with Aadhaar, making it easier to use across government services.

Process to Obtain PAN Card 2.0

- Online Application:

- Visit the official NSDL or UTIITSL website. www.nsdl.gov.in

- Opt for an instant e-PAN using your Aadhaar number.

- Aadhaar-Based Verification:

- Authenticate using an OTP sent to your Aadhaar-registered mobile number.

- Issuance:

- Once verified, an e-PAN with the Dynamic QR code will be issued instantly.

- Physical cards, if opted for, will be dispatched within a few days.

- Download e-PAN:

- Access your e-PAN via the official portal or DigiLocker.

Who Can Apply for PAN Card 2.0?

- Any individual, business entity, or non-resident Indian eligible for a PAN.

- Applicants must have an Aadhaar card for instant issuance.

Conclusion

India’s financial system is modernized by PAN Card 2.0, which streamlines, secures, and expedites identity verification and tax compliance. It meets the demands of a tech-savvy populace and is a step towards digitization.