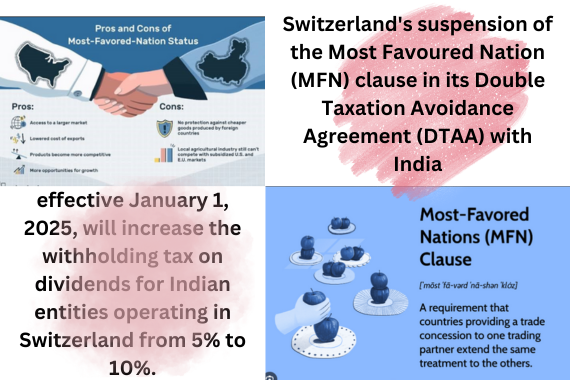

Switzerland’s suspension of the Most Favoured Nation (MFN) clause in its Double Taxation Avoidance Agreement (DTAA) with India, effective January 1, 2025, will increase the withholding tax on dividends for Indian entities operating in Switzerland from 5% to 10%.

Implications for Stock Market Investors:

- Increased Tax Obligations: Indian enterprises engaged in Swiss operations, especially within the financial services, pharmaceuticals, and IT sectors, are likely to encounter elevated tax obligations on dividends. This situation may diminish their profitability and could adversely influence stock valuations.

- Effect on Foreign Investments: The elevated tax rate may discourage Swiss investments in Indian firms, thereby impacting capital inflows and stock performance, particularly for companies with substantial Swiss investor participation.

- Market Perception: The suspension highlights difficulties in international tax agreements, which may create uncertainties and undermine investor confidence in companies operating on a global scale.

Read:https://coveragezone31.com/one-nation-one-election

Table of Contents

Investor Considerations:

- Portfolio Evaluation: Evaluate the exposure to firms with significant operations or investments in Switzerland, as they may face heightened tax obligations that could affect their profitability.

- Risk Diversification: Reduce risks by spreading investments across various sectors and regions that are less likely to be impacted by alterations in tax treaties.

- Ongoing Monitoring: Remain vigilant regarding possible renegotiations of the India-Switzerland tax treaty, as forthcoming modifications could reshape the tax environment and influence investment outcomes.

In summary, while the suspension of the MFN clause introduces specific tax challenges for Indian entities in Switzerland, its broader impact on the Indian stock market will depend on individual company exposures and the overall investment climate.

This context adds an important legal backdrop to the decision. Here’s a deeper dive into its significance:

- Supreme Court Ruling Impact:

The ruling elucidated that the Most Favored Nation (MFN) clause in India’s tax treaties does not automatically extend to countries that become members of the OECD subsequent to the signing of a treaty with India. Switzerland, which became an OECD member in 1961, remains subject to the particular provisions of its tax treaty with India. Nonetheless, the ruling underscores that any advantages associated with the MFN clause must be explicitly renegotiated rather than presumed. - Swiss Finance Department’s Response:

Switzerland’s decision to suspend India’s Most Favored Nation (MFN) status reflects an alignment of its tax treaty framework with the interpretation provided by the Supreme Court. This action indicates Switzerland’s intention to reevaluate or renegotiate the treaty in accordance with clarified legal parameters, which will influence the taxation of dividends and investments. - Potential Consequences:

- For India: This suspension may establish a benchmark for other nations to reconsider their tax agreements with India, potentially resulting in analogous situations that elevate tax obligations for Indian firms engaged in international operations.

- For Investors: While legal clarity may cause temporary disturbances, it ultimately provides a more transparent long-term investment landscape. Firms that depend significantly on treaty advantages may need to reassess their financial approaches.

This development highlights the importance of aligning tax treaties with judicial interpretations and the growing complexity in international tax frameworks.

The Most Favoured Nation (MFN) status is a principle in international trade that ensures equal treatment among trading partners. Here’s a detailed explanation:

What is MFN Status?

- Core Principle of WTO Rules:

Under the World Trade Organization (WTO) framework, the MFN clause requires countries to offer the same trade terms—tariffs, quotas, and regulations—to all trading partners. For example, if a country lowers a tariff for one trading partner, it must extend the same benefit to all WTO members. - Purpose:

- Averts discrimination among trading partners.

- Facilitates equitable and open trade by establishing uniform regulations for all participants.

- Fosters international economic collaboration and access to markets.

Implications of Switzerland Suspending MFN Status for India

Switzerland’s suspension of MFN status could have significant repercussions:

- Increased Tariffs: Indian exporters could experience heightened customs duties on their products entering Switzerland, which may render Indian goods less competitive in comparison to those from nations that continue to benefit from Most Favored Nation (MFN) status.

- Additional Trade: Obstacles: Indian products and services might face more stringent regulations, including quotas or compliance mandates, which would further elevate costs and diminish the appeal of the market.

- Limited Market Access: In the absence of MFN status, Indian exporters may forfeit preferential treatment, constraining their capacity to grow within the Swiss market. This situation could adversely impact sectors such as pharmaceuticals, IT services, and textiles, where Indian exports to Switzerland are significant.

- Investor Confidence: The suspension could be interpreted as a move towards protectionism, potentially undermining foreign investors’ confidence in Indian enterprises aiming to penetrate the Swiss market.

Broader Impacts on Indian Economy

- Export Slowdown:

Indian exporters reliant on the Swiss market may need to reassess their pricing strategies or find alternative markets to offset the cost impact. - Policy Recalibration:

India might engage in diplomatic talks with Switzerland to renegotiate terms or implement retaliatory measures, adding complexity to trade relations. - Sectoral Impact:

Industries like jewelry, precision engineering, and pharmaceuticals—key areas of Indo-Swiss trade—may experience slowed growth or reduced profitability.

In conclusion, while the suspension of MFN status by Switzerland introduces challenges for Indian trade and investments, it also emphasizes the need for robust diplomatic and strategic responses to safeguard economic interests.

Indian Governments response against Switzerland move

The Indian government’s response to Switzerland suspending the MFN status reflects a measured approach, emphasizing renegotiation to address the evolving dynamics of international trade and taxation.

Key Highlights from the Indian Government’s Statement:

- Acknowledgment of the Need for Renegotiation:

- Trade Pact with EFTA: The Indian government has linked the issue to its trade pact with the European Free Trade Association (EFTA), of which Switzerland is a member.

- The renegotiation will likely aim to align the Double Taxation Avoidance Agreement (DTAA) with newer economic realities and trade agreements.

- Diplomatic Reassurance:

- MEA Spokesperson Randhir Jaiswal reassured that India is committed to addressing the issue through dialogue, minimizing potential disruptions to bilateral trade and investments.

- This shows India’s intent to preserve economic ties with Switzerland and EFTA while safeguarding its interests.

- Strategic Focus on EFTA Negotiations:

- EFTA comprises Switzerland, Norway, Iceland, and Liechtenstein, countries with significant trade links to India.

- India’s ongoing negotiations with EFTA for a Free Trade Agreement (FTA) could influence the terms of the DTAA renegotiation, potentially mitigating the adverse impacts of the MFN suspension. Source https://www.news18.com/

Implications of Renegotiation

- For Taxation:

- The renegotiation could address the withholding tax issue, potentially reducing the impact on dividends and Indian companies operating in Switzerland.

- For Trade:

- Ensuring better market access and favorable tariffs under the EFTA framework might counterbalance the loss of MFN privileges.

- For Investors:

- A renegotiated treaty with clearer terms might boost investor confidence by reducing uncertainties regarding taxation and trade policies.

Broader Perspective

The Indian government’s emphasis on renegotiation signals a proactive stance. While the suspension of MFN status by Switzerland introduces temporary challenges, India appears poised to leverage its trade negotiations with EFTA to achieve a mutually beneficial resolution.

India-Switzerland Trade Partnership Overview

The trade relationship between India and Switzerland is robust, characterized by significant bilateral trade and investment flows. Here’s a breakdown:

Bilateral Trade (FY 2023-24)

- Total Trade Volume: $23.76 billion

- Imports from Switzerland: $21.24 billion (89.4%)

- Exports to Switzerland: $2.52 billion (10.6%)

- Key Import Items from Switzerland:

- Gold and Silver: Crucial for India’s jewelry sector.

- Pharmaceutical Intermediates: Used in India’s growing pharmaceutical manufacturing industry.

- Machinery: Supporting industrial and infrastructure projects.

- Key Export Items to Switzerland:

- Pharmaceutical Products: Reflecting India’s strong position as a global pharmacy.

- Gems and Jewelry: A significant contributor to India’s export earnings.

- Organic Chemicals: Used in various industrial applications.

- Machinery: Indicative of India’s expanding manufacturing capabilities.

Foreign Direct Investment (FDI)

- FDI Inflows: $10.72 billion (April 2000 – September 2024)

- Reflects Switzerland’s significant role as a source of FDI in India.

- Investments are primarily in sectors like pharmaceuticals, financial services, and machinery manufacturing.

Economic Importance of the Partnership

- Trade Balance:

- India runs a significant trade deficit with Switzerland, largely due to its high gold and silver imports.

- Jewelry Sector Reliance:

- The import of precious metals is essential for India’s gems and jewelry industry, a key export sector and employment generator.

- Pharmaceutical Synergy:

- Both countries have a strong pharmaceutical sector, creating potential for joint ventures and technology transfers.

- Machinery and Technology:

- Imports from Switzerland contribute to India’s industrial growth, especially in precision machinery and advanced manufacturing equipment.

Challenges and Opportunities

- Challenges:

- The suspension of the MFN status and the renegotiation of the DTAA might impact the cost structures of Indian companies operating in or trading with Switzerland.

- Opportunities:

- The ongoing negotiations for an India-EFTA Free Trade Agreement (FTA) could address trade imbalances and facilitate greater market access for Indian exports.

- There is potential for increased collaboration in green technologies, AI, and precision engineering.

Future Outlook

Despite temporary setbacks like the MFN suspension, the India-Switzerland trade partnership is expected to grow. Strategic renegotiations of trade and taxation frameworks, coupled with evolving economic collaborations, could strengthen this relationship further.