PropShare Platina REIT has taken the Indian financial market by storm, debuting on December 10 at Rs 10.5 lakh per unit on the BSE, making it the country’s most expensive security. By the close of its first trading session, it settled at Rs 10.45 lakh per unit, surpassing Elcid Investments as the costliest tradeable security.

Elcid Investments’ Historic Surge

Previously, Elcid Investments held the record, with shares soaring to Rs 2.36 lakh crore in valuation on October 29. The surge followed a special price discovery auction by the Bombay Stock Exchange (BSE) for holding companies, marking a 66.92 million percent increase from its original price of Rs 3.53 per share.

Elcid Investments retains its position as India’s priciest stock despite being dethroned by PropShare Platina REIT in terms of tradeable unit cost.

PropShare Platina REIT: A Landmark Issue

PropShare Platina REIT is the first entity licensed under the new SM REIT regulations introduced by SEBI in March 2024. The Rs 353 crore issue, open for subscription from December 2 to December 4, was oversubscribed 1.19 times, reflecting strong investor demand.

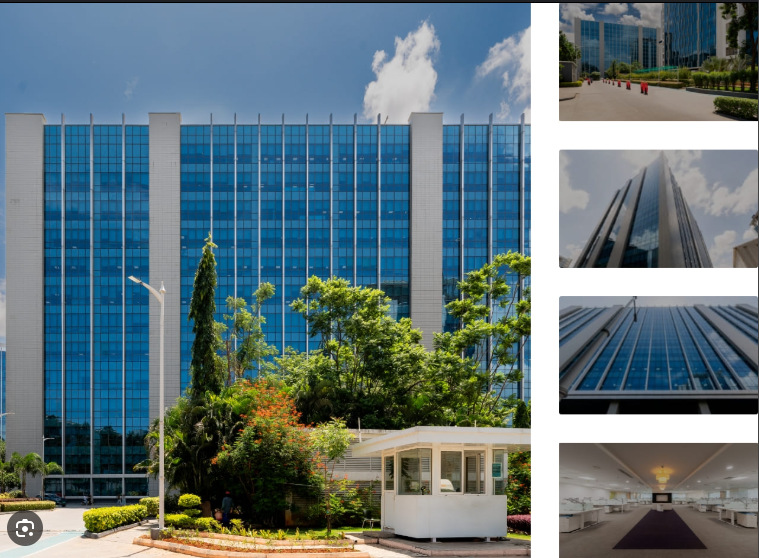

The REIT features 246,935 square feet of LEED Gold-certified office space in Prestige Tech Platina, Bangalore, leased to a U.S.-based technology company under a 9-year agreement. Investors are promised attractive distribution yields of 9.0% for FY26, 8.7% for FY27, and 8.6% for FY28.

Market Implications

The debut of PropShare Platina REIT underscores the evolving Indian securities market and the rising interest in real estate investment trusts. It also highlights the growing trend of high-value securities commanding attention among niche investors. Source www.moneycontrol.com

Disclaimer

This article is for informational purposes only. Consult certified financial advisors for investment decisions.

Table of Contents

Also Read:https://coveragezone31.com/wazirx

Most Expensive listed securities Globally and in India

Here are some of the most expensive listed securities globally and in India, categorized by regions and sectors:

Globally

- Berkshire Hathaway (Class A)

- Price: ~$560,000 per share (as of late 2024)

- Exchange: New York Stock Exchange (NYSE)

- Reason for High Price: Warren Buffett’s investment conglomerate does not split its Class A shares, maintaining exclusivity and value.

- NVR Inc.

- Price: ~$6,500 per share

- Exchange: NYSE

- Industry: Real Estate and Construction

- Reason for High Price: High profitability and limited share splits.

- Seaboard Corporation

- Price: ~$4,000 per share

- Exchange: NYSE American

- Industry: Agribusiness and Shipping

- Reason for High Price: Strategic decision to avoid splits and focus on long-term investors.

India

- PropShare Platina REIT

- Price: Rs 10.5 lakh per unit (2024 debut)

- Exchange: BSE

- Type: Real Estate Investment Trust

- Highlight: Features premium office spaces in Bangalore with high projected yields.

- Elcid Investments

- Price: Rs 2.36 lakh per share

- Exchange: BSE

- Industry: Holding Company

- Highlight: Holds a 2.95% stake in Asian Paints, valued at Rs 8,000 crore.

- MRF Ltd.

- Price: ~Rs 1.16 lakh per share

- Exchange: NSE and BSE

- Industry: Automotive Tyres

- Highlight: Renowned for its consistent performance and limited share splits.

- Page Industries

- Price: ~Rs 37,000 per share

- Exchange: NSE and BSE

- Industry: Apparel (Jockey’s exclusive licensee in India)

- Highlight: High profitability and strong brand association.

Factors Influencing High Prices

- Limited Stock Splits:

- Companies like Berkshire Hathaway, MRF, and Seaboard avoid frequent splits to maintain exclusivity and attract long-term investors.

- Market Perception and Value:

- Holding companies like Elcid Investments gain high valuations due to valuable stakes in other high-performing entities (e.g., Asian Paints).

- Unique Financial Structures:

- REITs like PropShare Platina represent bundled real estate assets, often debuting at premium prices.

- High Earnings Per Share (EPS):

- Consistent profitability boosts share values, as seen in NVR Inc. and MRF.

These high-priced securities often cater to niche investors, emphasizing stability, profitability, and long-term returns over broader retail participation.